Fundamental analysis serves as the bedrock for making informed trading decisions in financial markets. By examining economic indicators, balance sheets, and other financial documents, you gain a deeper understanding of asset valuation and market trends. Trading strategies grounded in a thorough analysis of profit margins, trading volume, and industry conditions enable you to forecast revenue and project earnings more accurately. Understanding financial ratios and security pricing can enhance your equity analysis, while insights into dividend yield and market capitalization can shape your investment approach. Factors like interest rates, inflation data, and the economic cycle are critical for gauging company performance and growth prospects. Corporate governance, cash flow, and demand supply analysis further inform your risk assessment and return on investment strategies. Grasping these elements allows you to unlock market success and master fundamental analysis effectively.

Fundamental analysis is a cornerstone of effective trading strategies, allowing you to evaluate financial markets through a variety of lenses. By diving into economic indicators and financial documents such as balance sheets, you can gauge asset valuation and market trends effectively. This approach provides insights into profit margins and trading volume, helping you make more informed investment decisions amidst fluctuating industry conditions.

Analyzing revenue forecasts and earnings projections is central to equity analysis, while financial ratios and security pricing offer additional layers of understanding. Keeping an eye on dividend yield and market capitalization enables you to assess company performance and growth prospects more accurately. The current state of financial markets shows a growing dependence on precise economic policies and interest rates, emphasizing the importance of timely, in-depth analysis.

Factors like inflation data, the economic cycle, corporate governance, and cash flow are essential for comprehensive risk assessments and return on investment calculations. Trend analysis highlights how relative value and demand supply dynamics influence market movements. Understanding these components equips you with a robust framework, enabling you to navigate the complexities of financial markets confidently.

Interpreting economic indicators is crucial for effective trading strategies. These indicators, such as interest rates, inflation data, and employment statistics, provide a snapshot of the overall health of financial markets and can greatly influence investment decisions. By understanding these economic measures, you can anticipate market trends and make more informed decisions about asset valuation and security pricing.

While many believe that short-term fluctuations in economic indicators are sufficient for predicting market movements, there’s a strong case for focusing on long-term trends. Long-term analysis of these indicators, such as the economic cycle and growth prospects, offers a more stable foundation for your trading strategies. This approach helps you avoid the noise of daily market volatility and allows for more accurate risk assessment.

Examining economic indicators in conjunction with balance sheets and financial ratios offers a holistic view of a company's performance and relative value. Indicators like revenue forecasts, profit margins, and trading volume can reveal deeper insights into corporate governance and cash flow. This comprehensive approach ensures you’re well-prepared to assess market capitalization and investment opportunities with greater precision.

Understanding the broader economic policies and demand supply analysis is equally important. These factors shape industry conditions and ultimately, company performance. By mastering the interpretation of economic indicators, you’re better equipped to navigate the complexities of the financial markets and make sound investment decisions.

Exploring financial statements is essential for a thorough fundamental analysis. These documents, which include balance sheets, income statements, and cash flow statements, provide a detailed look at a company's financial health. Balance sheets offer a snapshot of asset valuation and liabilities, giving you a clear picture of market capitalization and security pricing. Income statements reveal profit margins, revenue forecasts, and earnings projections, crucial for equity analysis and assessing company performance.

Tracing its evolution from the early 20th century, modern financial reporting has become more standardized, facilitating easier and more accurate analysis for traders. Historical context shows that increased regulation and improved corporate governance practices have led to more reliable data. Today, financial ratios extracted from these statements help you evaluate relative value and compare industry conditions. A company's cash flow statement, for example, can highlight trends in liquidity and operational efficiency, informing your risk assessment and return on investment calculations.

Understanding these elements is vital for identifying long-term growth prospects and making sound investment decisions. Economic indicators, when coupled with financial statements, provide insight into the impact of economic policies and interest rates on company performance. The thorough examination of trading volume, market trends, and dividend yield, helps in forming effective trading strategies. Thus, mastering the interpretation of financial statements enables you to navigate the complexities of the financial markets proficiently.

Delving into market trends is an integral part of developing effective trading strategies. By examining trading volume, you can gauge market sentiment and anticipate potential price movements. Analyzing historical data helps you understand how economic indicators like inflation data and interest rates influence asset valuation and profit margins. Such insights ensure your investment decisions are rooted in solid data, reducing the risk of adverse outcomes.

According to recent studies, the principles of behavioral finance explain how market trends can often be driven by investor psychology rather than fundamental factors alone. This scientific finding highlights the importance of understanding both the rational and emotional aspects of market behavior. Recognizing these patterns allows you to anticipate momentum shifts and adjust your trading strategies accordingly.

Market trends also reflect underlying industry conditions and economic policies that impact company performance. A thorough analysis of revenue forecasts, earnings projections, and balance sheets offers a clearer picture of an industry's growth prospects and relative value. This comprehensive approach helps you stay ahead of the economic cycle, enabling better equity analysis and financial ratios evaluation.

Keeping an eye on demand supply analysis and corporate governance provides additional layers of insight into how market trends develop. For example, a company's cash flow and dividend yield can inform your risk assessment and return on investment strategies. Understanding these factors equips you to navigate the complexities of financial markets more effectively, ensuring you make well-informed investment decisions.

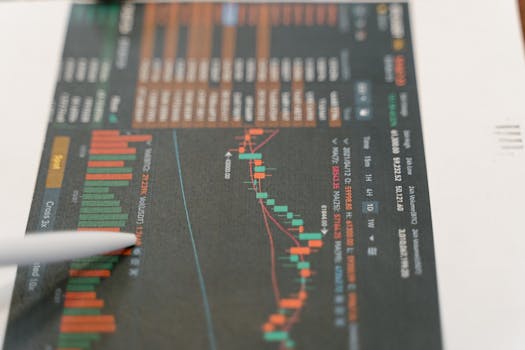

How does mastering technical analysis vs fundamental analysis impact your trading performance? Both approaches offer unique insights into financial markets and can enhance your investment decisions. Technical analysis focuses on price movement and trading volume, using charts and patterns to predict future market trends. This method is invaluable for short-term strategies, allowing you to identify entry and exit points with precision.

Fundamental analysis, on the other hand, delves into economic indicators, balance sheets, and profit margins to gauge the intrinsic value of an asset. It helps you understand market trends and long-term growth prospects by offering a comprehensive view of economic policies and company performance. By examining revenue forecasts, earnings projections, and financial ratios, you can make more informed trading decisions based on the underlying health of a company or industry.

Combining both technical and fundamental analysis can provide a more holistic view of the financial markets. For example, while technical analysis might signal a buying opportunity based on a particular pattern, fundamental analysis can confirm this signal by showing strong revenue growth and solid cash flow. This dual approach enhances your risk assessment and return on investment strategies, offering a balanced perspective.

Moreover, understanding market capitalization, dividend yield, and security pricing through fundamental analysis complements the timing precision offered by technical analysis. Economic indicators like interest rates and inflation data can influence company performance and market cycles, making it essential to integrate both analysis methods. This comprehensive understanding equips you to navigate the complexities of the markets more confidently, ensuring well-rounded investment strategies.

Balancing these two approaches also allows for better adaptation to market conditions. While technical analysis is often more relevant in bullish or bearish markets, fundamental analysis provides stability during periods of economic uncertainty. Mastering both techniques empowers you to make sound investment decisions, maximizing opportunities in various market environments.

Using fundamental analysis in Forex trading provides a comprehensive outlook that goes beyond mere price movements. By examining economic indicators like interest rates and inflation data, you can predict currency fluctuations more accurately. Economic policies and conditions play a significant role in shaping currency values, making it essential to stay updated on these factors. These insights form the cornerstone of your Forex trading strategies.

In the next few years, fundamental analysis is likely to become increasingly pivotal for Forex traders as global economic conditions evolve. Factors like market trends, trading volume, and economic cycles will only grow in importance. A thorough analysis of balance sheets, cash flow, and corporate governance can provide deeper insights into relative value and demand-supply dynamics in the Forex market. This detailed approach ensures you're making well-informed investment decisions.

Earnings projections, revenue forecasts, and company performance also play a role, even though they are more commonly associated with stock trading. Understanding these elements helps in assessing the overall economic environment, indirectly affecting currency pairs. By integrating financial ratios, security pricing, and profit margins, you create a robust framework to navigate the complexities of Forex trading.

Economic indicators like GDP growth, employment statistics, and trade balances are essential for assessing the strength of different currencies. Your risk assessment and return on investment calculations benefit from this comprehensive approach, allowing for more accurate predictions. Integrating fundamental analysis with your Forex trading strategies ensures a well-rounded perspective, enabling you to capitalize on market opportunities more effectively.

Get free resources, tips & tricks, exclusive news, and special offers by joining the Cryptonite Newsletter.